Business Owner’s Policy

Protect your gym, trainers, and clients with customised Sports and Fitness Insurance covering liability, property damage, and injuries across California.

Business Owner’s Policy Is Ideal for Fitness Businesses

In the fast-paced world of fitness and sports, business owners face a unique mix of physical risk and operational challenges. A Business Owner’s Policy (BOP) simplifies coverage by combining general liability and commercial property insurance into a single, cost-effective plan. For gyms, yoga studios, personal trainers, and sports clubs in California, this policy offers comprehensive protection against accidents, injuries, and property losses—all in one package.

California’s fitness industry operates under strict regulations and high client expectations. Whether you own a boutique Pilates studio or a full-scale fitness centre, one lawsuit or fire could significantly affect your operations. A BOP provides peace of mind by covering both your facility and your professional liability exposures. For instance, if a client slips in your studio, or your gym equipment is damaged due to fire or theft, your BOP ensures you’re financially protected.

Many small businesses in California’s sports and wellness sector choose a BOP because it’s more affordable than purchasing separate policies. You can also customise it with additional coverage options—such as business interruption insurance or equipment breakdown coverage—to fit your specific operation. Explore how your business can benefit through Business Owner’s Policy (BOP) Insurance California

What’s Included in a Business Owner’s Policy for Fitness Centres and Studios

A BOP is built to handle the real-world risks of running a fitness or sports business in California. The policy generally includes two major components: general liability insurance and commercial property insurance, and often allows additional add-ons depending on your business type.General Liability Insurance: Covers bodily injury, property damage, and legal costs if a client or visitor is hurt during classes or training sessions. For example, if a participant trips over a weight rack, this portion of your BOP would handle their medical expenses and any related lawsuits

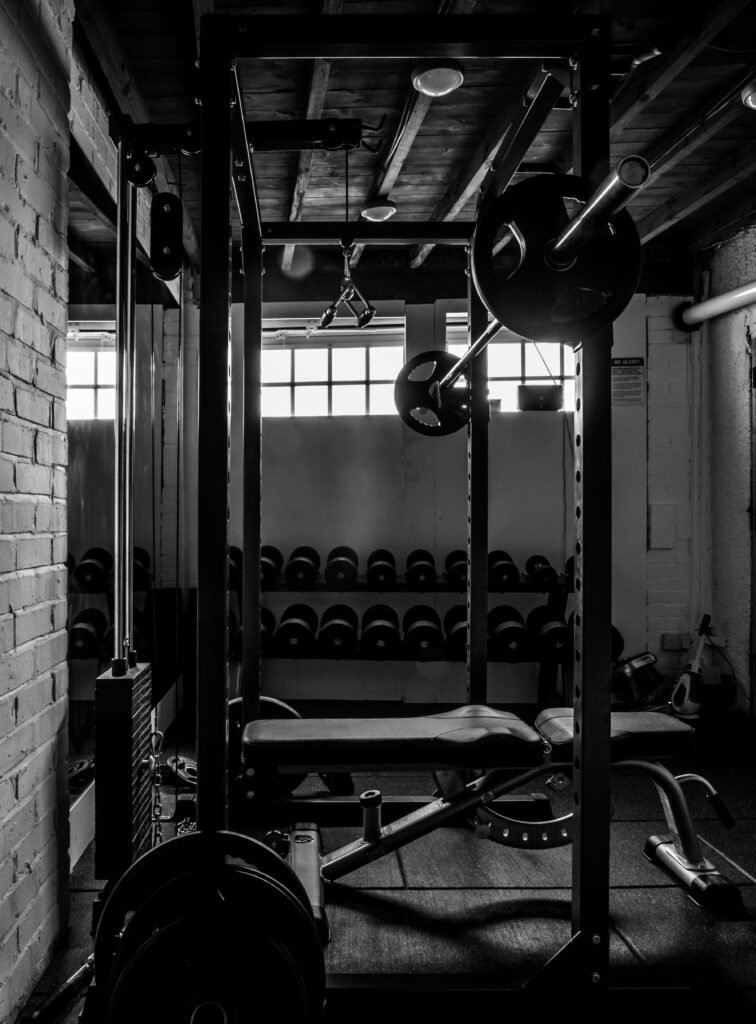

Commercial Property Insurance: Protects your building, studio, or gym equipment from fire, theft, or vandalism. Whether you own or lease your facility, this coverage helps you recover from unexpected physical losses.

Business Interruption Coverage (Optional): Helps replace lost income if your fitness centre must close temporarily due to covered damage, ensuring you can still meet payroll and expenses.

Because sports and fitness facilities often have high-value assets and frequent public interactions, a BOP provides a balanced solution—protecting both your equipment investment and your business reputation. California insurers also often allow you to include cyber liability or employee dishonesty protection within the same policy for added security.

How to Choose the Right BOP for Your Fitness Business in California

Choosing the right Business Owner’s Policy starts with evaluating your business size, assets, and client volume. A small yoga studio may need less property coverage but stronger professional liability protection, while a large gym with multiple employees may need additional endorsements like workers’ compensation or employment practices liability insurance.

Work closely with an insurance provider experienced in the California fitness sector. They can help you understand how to structure your coverage limits to match your business risks. For instance, property in cities like Los Angeles or San Diego may need higher limits due to local building costs and natural disaster exposure.

To keep premiums low, demonstrate your business’s safety commitment—maintaining equipment, posting clear signage, and following proper training standards. Some insurers reward gyms with risk management discounts when they implement preventive measures like regular safety inspections or staff training programs.

Sports and Fitness Insurance

Comprehensive Coverage for Active Professionals and Facilities

Member Protection

Comprehensive Sports and Fitness Insurance ensuring client safety, covering injuries, medical expenses, and unexpected accidents during training sessions.

Instructor Liability Coverage

Protects fitness trainers and coaches with Sports and Fitness Insurance that handles liability claims arising from accidents or client injuries.

Property & Equipment Coverage

Safeguards studios, gyms, and fitness centres with Sports and Fitness Insurance for property damage, stolen gear, and repair costs.

Employee Injury Protection

Covers staff and trainers under Sports and Fitness Insurance with essential workers’ compensation and medical liability

benefits.

Frequently Asked Question Services

Find quick, expert answers to help you understand your sports and fitness insurance coverage and make confident decisions for your business.

No, but it’s highly recommended. It combines liability and property coverage into one affordable package for fitness professionals.

Gyms, yoga studios, Pilates centres, martial arts schools, and personal training businesses all typically qualify if they meet size and revenue limits.

No, but you can purchase it separately. In California, workers’ comp is required for any business with employees.

Yes. Many California insurers allow endorsements to include professional liability within your BOP for added protection.

The Trusted Choice for Securing Your Fitness and Wellness Centre

From yoga studios to CrossFit gyms, we provide comprehensive insurance coverage designed to protect your business, clients, and equipment from everyday risks.

Our studio finally feels secure knowing we’re covered with the right insurance.