Insurance For Climbing Gym

Protect Your Indoor and Outdoor Climbing Gym with Customised Coverage for Liability, Staff, and Equipment.

Insurance for Climbing Gym

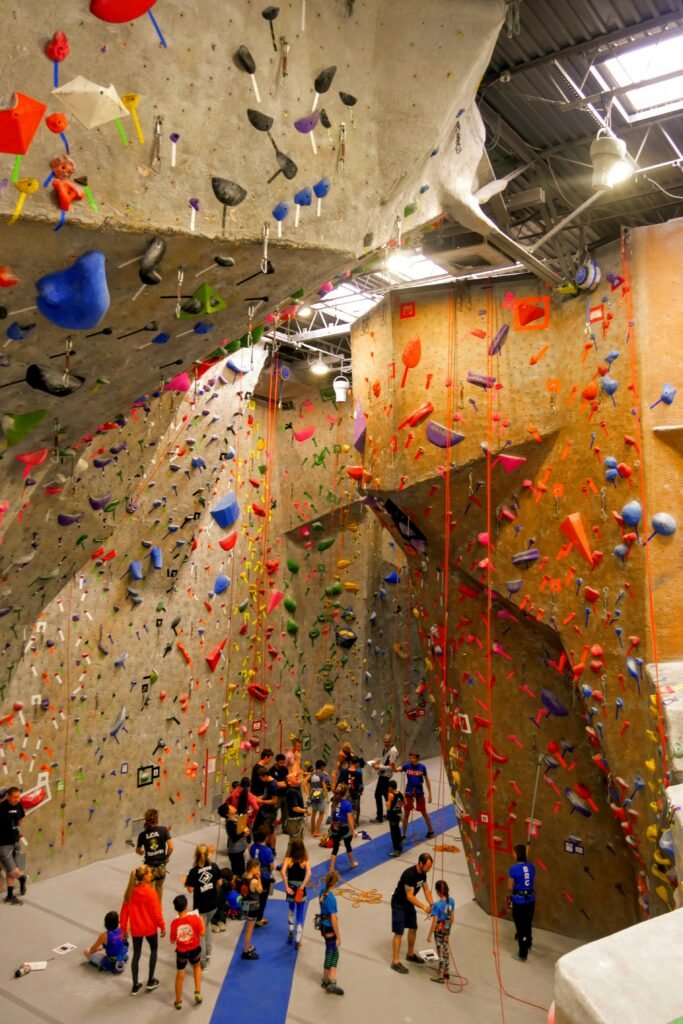

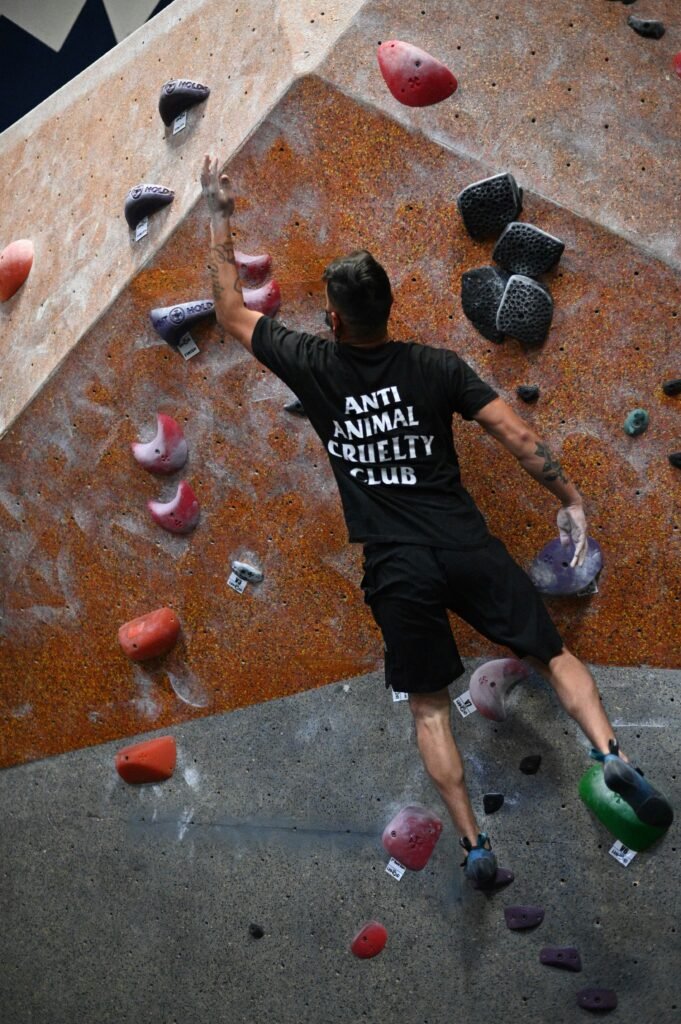

Running a climbing gym in California involves managing unique risks—ranging from member injuries to equipment damage and property loss. With customers constantly scaling walls, using harnesses, and testing their limits, the potential for accidents and claims is high. That’s why having the right climbing gym insurance is essential to safeguard your business against unexpected events.

Comprehensive insurance for climbing gyms provides financial protection against property damage, staff injuries, and third-party claims. It covers situations such as falls, equipment failures, and legal disputes that can arise even in well-supervised facilities. Whether you manage an indoor rock-climbing centre, bouldering studio, or outdoor adventure gym, the right coverage ensures your operations stay secure and compliant.

By tailoring your insurance package, you can include liability protection, business interruption coverage, and workers’ compensation to suit your facility’s exact needs. With California climbing gym insurance, you’ll have peace of mind knowing your business, staff, and climbers are protected—allowing you to focus on delivering a safe and challenging climbing experience.

General Liability for Climbing Gyms

Operating a climbing gym means dealing with inherent risks, especially injuries or property damage during climbing sessions. General Liability Insurance for climbing gyms protects your business from claims involving bodily injuries, property damage, and personal injury lawsuits. This coverage is essential for any facility that welcomes the public or hosts climbing events.

If a member falls and gets injured, or a visitor’s belongings are damaged due to gym operations, your liability coverage helps cover legal and medical expenses. Without this protection, even a single incident could lead to substantial out-of-pocket costs and reputational damage.

To learn more about comprehensive coverage options, visit General Liability Insurance California

Business Owner’s Policy (BOP) for Climbing Gyms

A Business Owner’s Policy (BOP) is ideal for climbing gym owners in California seeking an affordable and comprehensive insurance package. It combines general liability, commercial property, and business interruption insurance into one policy—covering both the operational and physical aspects of your business.

If a fire damages your climbing walls or a burst pipe floods your facility, the BOP helps pay for repairs and lost income while you recover. It also covers theft, vandalism, and other unexpected property damages that can disrupt daily operations.

Choosing a BOP for your climbing gym not only simplifies insurance management but also ensures you have well-rounded protection from multiple business risks. Learn more or start your coverage today at Business Owners Policy (BOP) Insurance California

Sports and Fitness Insurance

Comprehensive Coverage for Active Professionals and Facilities

Member Protection

Comprehensive Sports and Fitness Insurance ensuring client safety, covering injuries, medical expenses, and unexpected accidents during training sessions.

Instructor Liability Coverage

Protects fitness trainers and coaches with Sports and Fitness Insurance that handles liability claims arising from accidents or client injuries.

Property & Equipment Coverage

Safeguards studios, gyms, and fitness centres with Sports and Fitness Insurance for property damage, stolen gear, and repair costs.

Employee Injury Protection

Covers staff and trainers under Sports and Fitness Insurance with essential workers’ compensation and medical liability

benefits.

Workers’ Compensation Insurance for Climbing Gyms

If you employ instructors, maintenance staff, or administrative workers, Workers’ Compensation Insurance is required by California law. It provides essential benefits to employees who suffer work-related injuries or illnesses, covering medical costs, lost wages, and rehabilitation expenses.

In a climbing gym environment, employees may face risks such as strains, falls, or accidents while instructing or setting up climbing routes. Workers’ compensation ensures they receive prompt medical care and wage protection while helping your business remain compliant with state regulations.

Having Workers’ Compensation Insurance for climbing gyms not only protects your staff but also safeguards your business from costly lawsuits or penalties. Get more details about your obligations and coverage options at Workers’ Compensation Insurance California

Frequently Asked Question Services

Find quick, expert answers to help you understand your sports and fitness insurance coverage and make confident decisions for your business.

Because of the high-risk nature of climbing, insurance protects against injuries, lawsuits, and equipment or property damage.

At minimum, you should have general liability, workers’ compensation, and a BOP for full protection.

Yes, general liability coverage helps pay for medical costs and legal fees if a climber gets injured.

Yes, a BOP includes property coverage for climbing walls, ropes, harnesses, and flooring systems.

The Trusted Choice for Securing Your Fitness and Wellness Centre

From yoga studios to CrossFit gyms, we provide comprehensive insurance coverage designed to protect your business, clients, and equipment from everyday risks.

Our studio finally feels secure knowing we’re covered with the right insurance.